coweta county property tax rate

County Property Tax Facts Coweta. Thank you for visiting the Coweta County GA Website.

You are now exiting the Coweta County GA Website.

. The 2019 millage rate was 3989 mills per thousand dollars of assessed value which is slightly less than the 40 millage rate for 2018. That value is taken times a combined tax rate ie. Property taxes due Dec.

Thank you for visiting the Coweta County GA Website. Coweta County Tax Commissioner. The goal of the Coweta County Tax Assessors office is to annually appraise at fair market value all tangible real and personal property located in Coweta County by utilizing uniform methods and procedures to equally distribute the tax burden among our taxpayers.

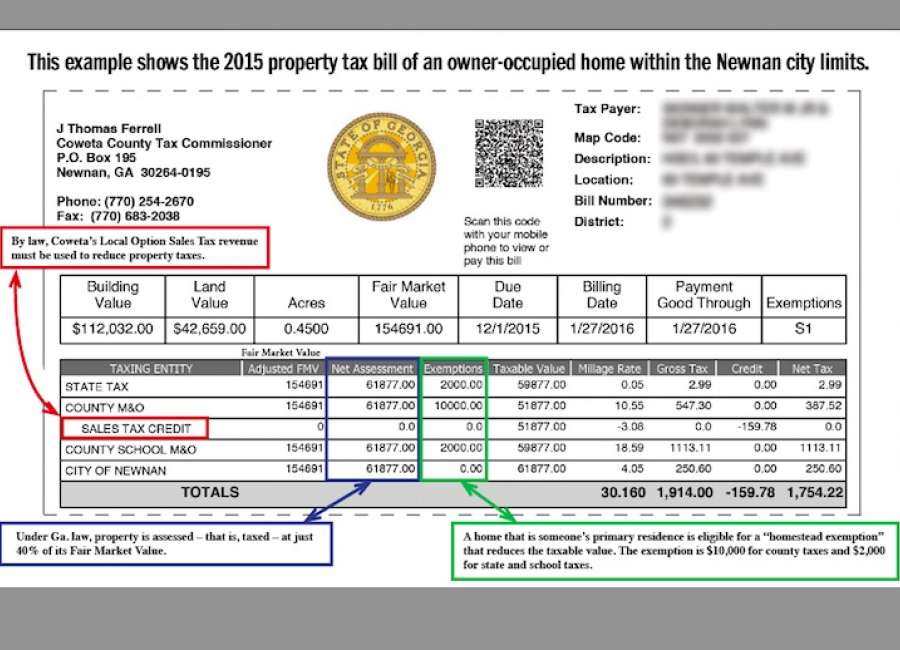

Everyone visiting the County Administration Building is required to enter through the East Broad St entrance. Coweta County GA currently has 621 tax liens available as of April 19. The Newnan City Council sets the millage rate each year in the summer based on digest information provided by Coweta County.

These buyers bid for an interest rate on the taxes owed and the right to collect back. The Coweta County GA Website is not responsible for the content of external sites. What is the property tax rate in Georgia County Coweta.

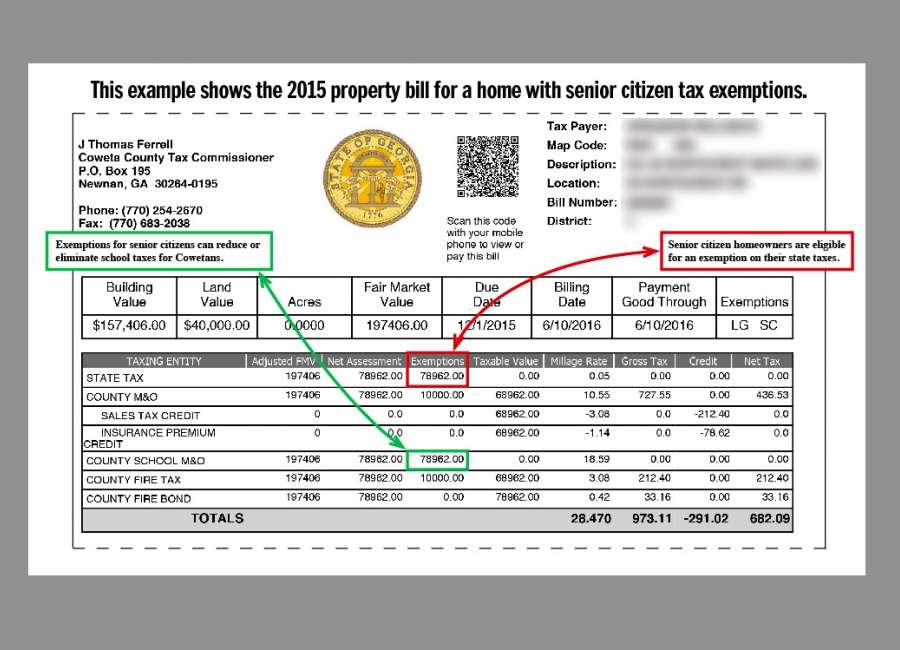

Coweta County collects on average 081 of a propertys assessed fair market value as property tax. The Coweta County GA Website is not responsible for the content of external sites. The sum of levies imposed by all related public entities.

Limited space is available in the lobby area. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Coweta County Tax Appraisers office. An appraiser from the county generally reassesses your propertys market value once every three years at least.

Coweta County Board of Commissioners - 22 East Broad Street Newnan GA 30263. Coweta County GA currently has 621 tax liens available as of April 19. The median property tax also known as real estate tax in Coweta County is 144200 per year based on a median home value of 17790000 and a median effective property tax rate of 081 of property value.

Coweta County Property Records are real estate documents that contain information related to real property in Coweta County Georgia. The Coweta County GA Website is not responsible for the content of external sites. The Kiosk allows you to renew and receive your renewal decal immediately.

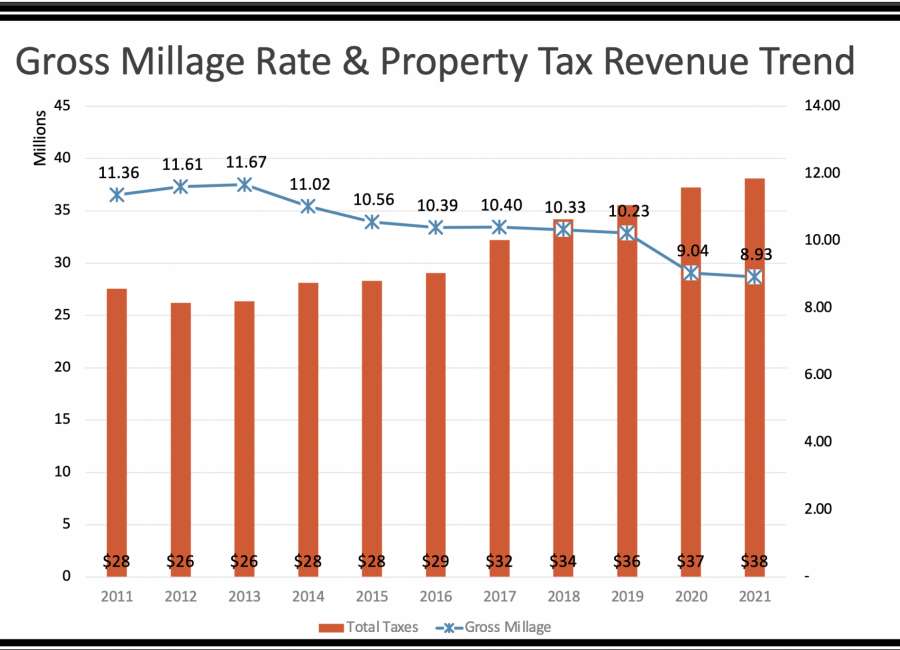

There were 122174 property tax appeals filed this represents 27 of parcels and 99 of total parcel value average value 805800. Those entities include your city Coweta County districts and special purpose units that make up that total tax rate. Please use the link below to plan your visit.

Use the Search and Pay Taxes link above to verify property tax payment received. Thank you for visiting the Coweta County GA Website. This is an 83 increase from the prior year.

As Ex-Officio Sheriff he may appoint Ex-Officio Deputy Sheriffs to act on his behalf in tax sale matters. The 2020 millage rate of 3643 was set by Council in August. Each Ex-Officio Deputy She riff has full power to advertise and bring property to sale for the purpose of collecting taxes due the state and county.

Thank you for visiting the Coweta County GA Website. At the Commission meeting held on August 7 2018 the. Coweta County Board of Commissioners - 22 East Broad Street Newnan GA 30263.

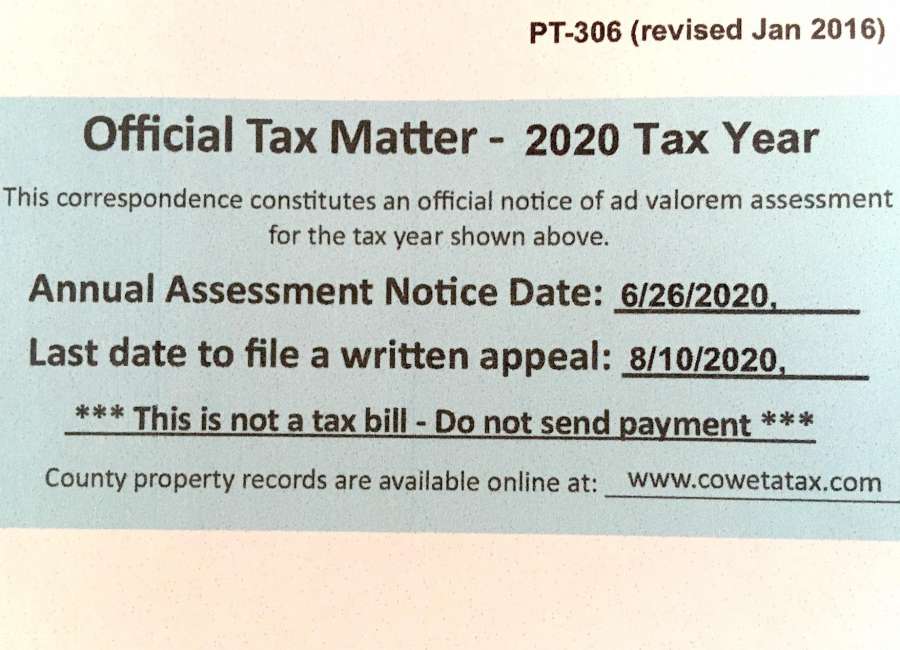

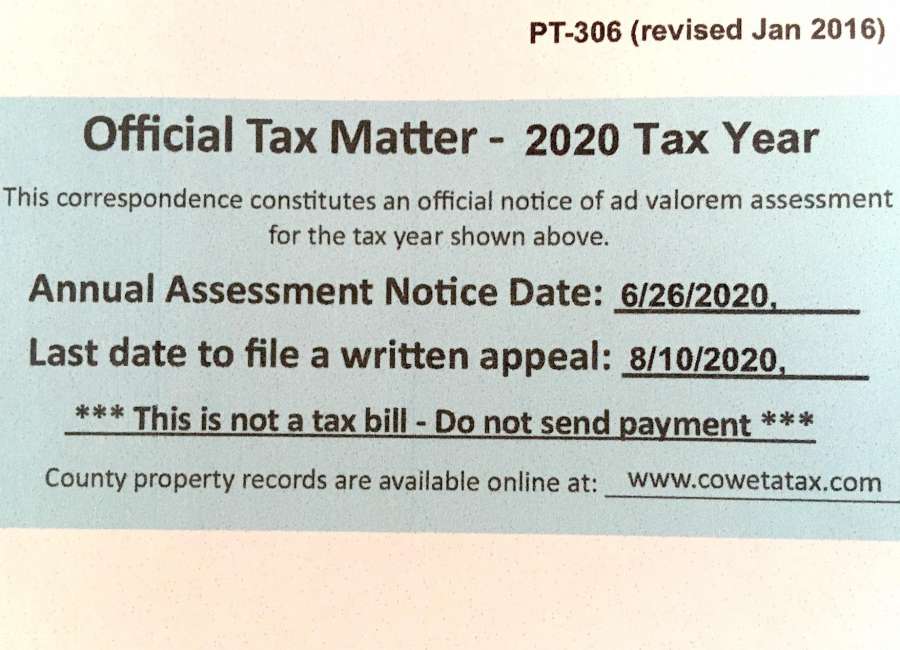

The digest is used by the various local taxing authorities the Coweta County Commissioners Board of Education and city councils to set the property tax millage rate and property taxes are due in late 2020. Whether you are currently a resident just pondering. The median property tax on a 17790000 house is 147657 in Georgia.

Property Tax hours 800am 430pm. Coweta County GA. In some counties the municipal and county governments have entered an agreement to have the county tax commissioner collect all taxes in a single billing.

Reading this recap youll acquire a practical perception of real property taxes in Coweta and what you can expect when your bill is received. On February 13 and March 22 2018 the Board of Commissioners conducted Called MeetingsPublic Hearings at the Pine Road Fairgrounds to garner input regarding the Coweta County Code of Ordinances as related to the preservation of rural character. Website Design by Granicus - Connecting People and Government.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Coweta County GA at tax lien auctions or online distressed asset sales. LAND DEVELOPMENT GUIDANCE SYSTEM. Coweta County Tax Commissioner Tommy Ferrell is reminding taxpayers that 2018 property taxes are due Monday Dec.

Many motor vehicle services including tag renewals are available at httpseservicesdrivesgagov. The median property tax on a 17790000 house is 144099 in Coweta County. The Tax Commissioner of Coweta County also serves as Ex-Officio Sheriff of Coweta County.

You will be redirected to the destination page below in 3 seconds. A NEW tag renewal Kiosk is available in the Newnan Crossing Kroger at 1751 Newnan Crossing Blvd. More than one-third 435 of appeals are settled or withdrawn before the hearing many of these do not receive a three-year freeze.

The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900. In all counties only the county tax commissioner is authorized to. You will be redirected to the destination page below in 3.

Public Property Records provide information on homes land or commercial properties including titles mortgages property. You will be redirected to the destination page below in 3.

One For Coweta Sales Tax Increase Passes News Tulsaworld Com

Reliable Support From A Qualified Accountancy Firm In London Services Business Services Tax Advisers Payroll C Certified Accountant Accounting Payroll

Georgia Sales Tax Guide For Businesses

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

County Sets Millage Rates The Newnan Times Herald

Property Tax Rates To Be Set In Next Few Weeks The Newnan Times Herald

Coweta School Board Approves 2021 22 Budget Winters Media

Property Values Skyrocket But Taxes Haven T Been Set The Newnan Times Herald

Georgia Property Tax Calculator Smartasset